The Web3

Builders Podcast

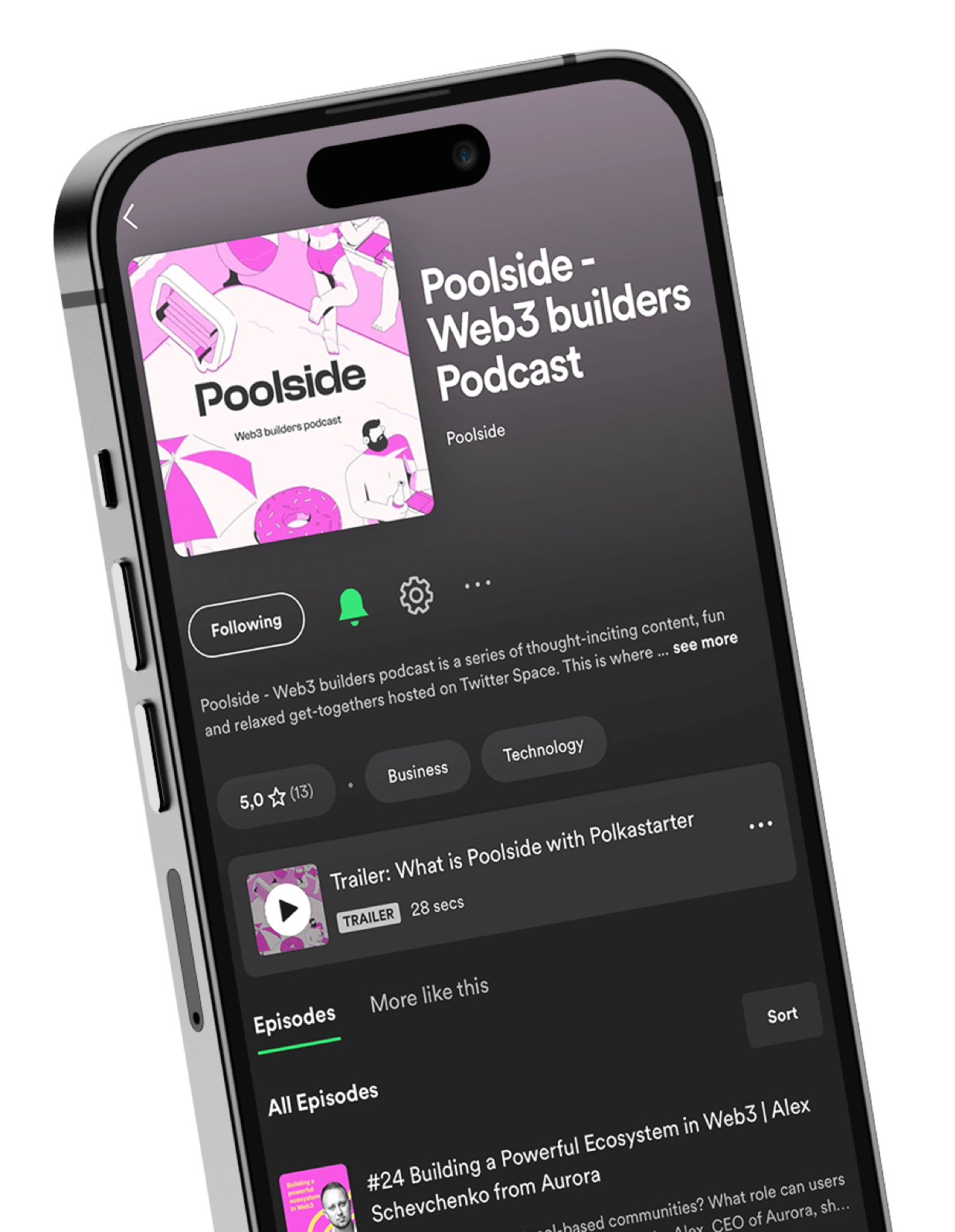

Welcome to a place where community and builders come together to discuss the hottest topics in crypto in an informal and conversational way, just as if we were all poolside with our favorite refreshments in hand and enjoying a healthy dose of Vitamin D.

‘Poolside, Web3 builders podcast’ is a series of thought-inciting discussions and interviews with Web3 founders and builders. We host fun, relaxed, and highly informative sessions, on Twitter Spaces and stream them on the podcast.

Twitter Spaces is the ultimate meeting point for audio conversations, enabling live, authentic, and engaging discussions between crypto heavyweights and the community.

.png)

.png)